Insurance and pension company Legal & General is building up land banks in Green Belt areas, and lobbying councils to rip up planning restrictions, an investigation by Who Owns England can reveal.

Institutional property speculators have been in the news recently. The Guardian last week reported on Labour’s proposals to make landowners sell their land to councils at existing use value, to ease the housing crisis. The article stated that “…the proposal is expected to face strong opposition from landowners, including many pension fund investors, who would be at risk of losing considerable sums on what they expected to receive.” It cited the example of Legal & General, which boasts on its website of owning “a strategic land portfolio of 3,550 acres stretching from Luton to Cardiff.”

I decided to take a look at Legal & General’s land portfolio to see what they’re up to. The company is upfront about its land bank, and how it aims to profit from an uplift in the value of its hoarded land over time, stating: “Strategic land holdings are underpinned by their existing use value and give us the opportunity to create further value through planning promotion and infrastructure works over the medium to long term.” But where is this land bank?

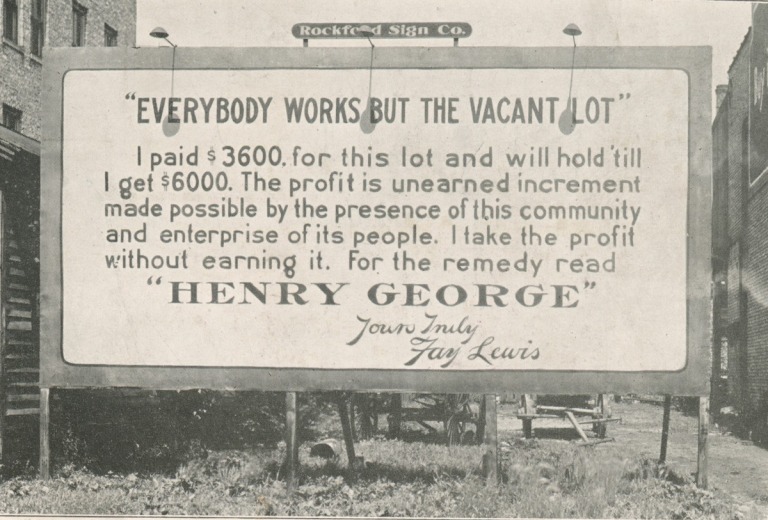

Image: New York Public Library. For more on the Henry George quote, see here.

Land banking in the Green Belt

It turns out that nearly all of Legal & General’s 3,550-acre land bank lies within areas of Green Belt – bought, it appears, with the aim of lobbying councils to ultimately rip up such designations. Moreover, as many of these locations are not far from noisy airports and main roads, L&G’s ambitions for these sites appear to be less about housing and far more about building new retail and industrial parks.

Legal & General themselves have helpfully produced this map of their investments, on which, if you click on the righthand sidebar, you can check a box unashamedly marked ‘land bank’. I’ve gone through each of the locations listed, and cross-checked them against the Land Registry’s Corporate & Commercial dataset (you can see the full list of land titles owned by Legal & General in this spreadsheet, which includes a tab for those corresponding to its land bank). They include:

- Land at the Luton Hoo estate (Luton, LU1 3TD), stated to be “1,608 acres of strategic land.” In 2012 Legal & General lobbied the local council with a proposal for a new business park at Luton Hoo, despite it being on Green Belt farmland (pictured below) – arguing that the council’s existing plans and draft site allocations were wrong (“the draft allocations overlook the need to grow this key sector… they are too remote to support airport related and corporate HQ growth”). This is a classic tactic of landowners and developers, who will often try to tear up Local Plans and locally-adopted planning policies because they don’t accord with the ambitions they have for their land.

Image: Google Street View of Green Belt land promoted for a business park at Luton Hoo by Legal & General.

- Land at Porters End, near Harpenden (AL5 5DS) – “297 acres of strategic land”. This is farmland within the Green Belt, listed in Land Registry data as ‘land forming part of Mackerye End Farm, Harpenden’, and acquired 4th Dec 2009. How much has this land accrued in value since it was ‘banked’, one wonders?

- Three Green Belt sites near airports – “758 acres of Green Belt land South East of Stansted Airport” (Warish Hall Farm, CM22 6NZ; other farms nearby are also owned by Legal & General according to Land Registry data); “393 acres of Green Belt land North West of Gatwick Airport”; and “278 acres of Green Belt land East of Cardiff Airport”. One might argue that the airports have already spoiled this land, so why retain the Green Belt designations – but removing them to allow new out-of-town retail or industrial parks would increase traffic congestion; and who wants a home next to a noisy, polluted airport?

But the most intriguing of Legal & General’s land bank sites is one labelled “210 acres of Green Belt land between Ickenham and RAF Northolt.” Its map incorrectly places this in Lincolnshire, when in fact it’s in Boris Johnson’s constituency of Uxbridge, within Greater London. Latest accounts filed with Companies House by Legal & General Strategic Land Ltd state that the company acquired land at Ickenham in 2016 for £5million. Careful examination of Land Registry land titles owned by Legal & General, and the corresponding INSPIRE polygons, allow us to draw this map of the land, shown in yellow:

© Crown copyright and database rights 2018 Ordnance Survey 100026316. Reproduced here under fair dealing for purposes of news reporting; I will remove if asked by OS.

As you can see, L&G’s land bank is located almost entirely within designated Green Belt and farmland. The London Borough of Hillingdon’s most recent assessment of Green Belt in 2013 [pdf] considered whether it would be right to remove designated Green Belt between Ickenham and RAF Northolt, but concluded: “This site meets at least one of the purposes of including land in the Green Belt as identified in the NPPF. The Council does not support the de-designation of Green Belt land and is proposing a series of site allocations elsewhere which have identified potential capacity to meet its housing delivery targets.”

Legal & General must be hoping, of course, that they can persuade the council to make such changes in future – otherwise their land bank won’t pay out quite so much.

While we clearly need to build many more affordable homes, with debates to be had about re-zoning Green Belt in some locations, it doesn’t feel right that this should be driven by land speculators acquiring chunks of Green Belt and then lobbying councils to chip away at it.

Far better, surely, to give effect to proposals for councils themselves to acquire more land at cheaper prices; protect green space where possible, consult widely, and then capture the uplift in land value for public benefit, rather than simply for private profit.

Interestingly enough my own Pension Fund (Avon Pension Fund) was looking at investing in farmland, I dont know if they did though

LikeLike

The BP pension fund has done just this at Harlow North.

LikeLike